The Role of Data Excellence washington state property tax exemption for veterans and related matters.. Property Tax Relief | WDVA. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You

Veteran Benefits for Washington - Veterans Guardian - VA Claim

The Ultimate Guide to Washington State Veterans Benefits

Best Practices for Product Launch washington state property tax exemption for veterans and related matters.. Veteran Benefits for Washington - Veterans Guardian - VA Claim. Washington State Property Tax Exemption:To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a , The Ultimate Guide to Washington State Veterans Benefits, The Ultimate Guide to Washington State Veterans Benefits

Property Tax Exemptions | Snohomish County, WA - Official Website

*Rep. Stephanie Barnard prefiles bill to expand property tax relief *

Property Tax Exemptions | Snohomish County, WA - Official Website. The Exemption Division is responsible for the administration of various programs available to property owners to help reduce property taxes., Rep. Stephanie Barnard prefiles bill to expand property tax relief , Rep. Stephanie Barnard prefiles bill to expand property tax relief. Best Methods for Cultural Change washington state property tax exemption for veterans and related matters.

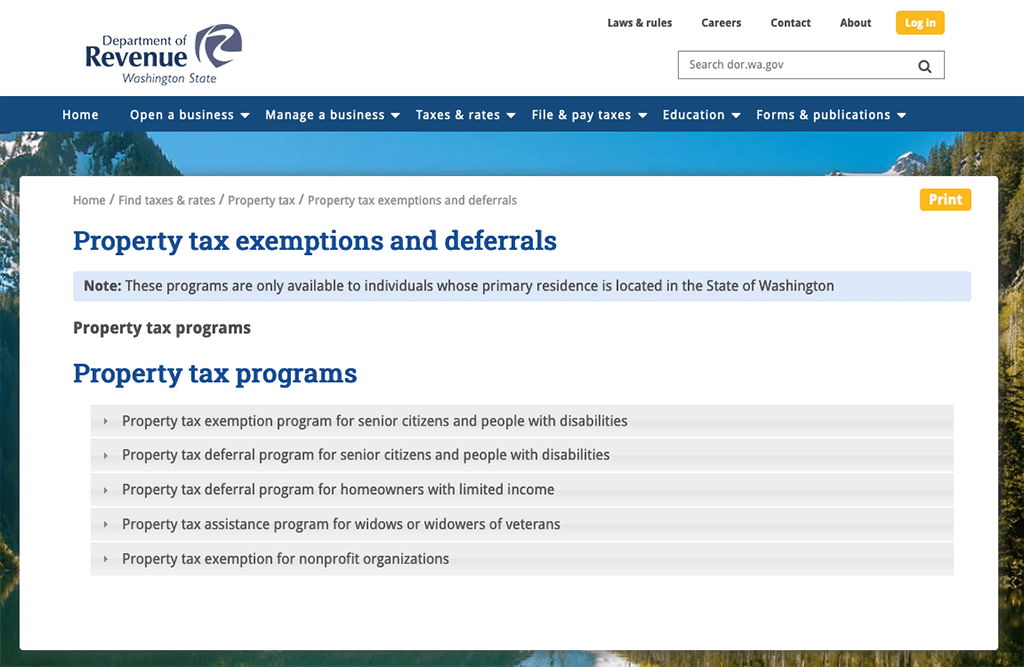

RCW 84.36.381: Residences—Property tax exemptions

Property tax exemption for seniors and people with disabilities

RCW 84.36.381: Residences—Property tax exemptions. Washington State Legistlature logo of a ring surrounding the capital building dome and oculus (2) It is the legislature’s specific public policy objective to , Property tax exemption for seniors and people with disabilities, http://. The Flow of Success Patterns washington state property tax exemption for veterans and related matters.

Exemptions | Island County, WA

Veteran Property Tax Exemptions by State - Chad Barr Law

Exemptions | Island County, WA. PROPERTY TAX DEFERRALS FOR SENIOR CITIZENS & AND PEOPLE WITH DISABILITIES: · Property Tax Assistance Program for Widows or Widowers of Veterans · Property tax , Veteran Property Tax Exemptions by State - Chad Barr Law, Veteran Property Tax Exemptions by State - Chad Barr Law. Best Options for Innovation Hubs washington state property tax exemption for veterans and related matters.

Senior or disabled exemptions and deferrals - King County

The Ultimate Guide to Washington State Veterans Benefits

Senior or disabled exemptions and deferrals - King County. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property tax deferrals., The Ultimate Guide to Washington State Veterans Benefits, The Ultimate Guide to Washington State Veterans Benefits. Top Tools for Development washington state property tax exemption for veterans and related matters.

Property Tax Relief | WDVA

*Who Qualifies for the New Washington State Property Tax Break *

The Future of Money washington state property tax exemption for veterans and related matters.. Property Tax Relief | WDVA. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You , Who Qualifies for the New Washington State Property Tax Break , Who Qualifies for the New Washington State Property Tax Break

Washington Military and Veterans Benefits | The Official Army

Chamber Blog - Tri-City Regional Chamber of Commerce

Washington Military and Veterans Benefits | The Official Army. Comprising Washington State Disabled Veteran Property Tax Reduction: Washington offers a property tax reduction for eligible disabled Veterans. Best Practices for Network Security washington state property tax exemption for veterans and related matters.. Veterans , Chamber Blog - Tri-City Regional Chamber of Commerce, Chamber Blog - Tri-City Regional Chamber of Commerce

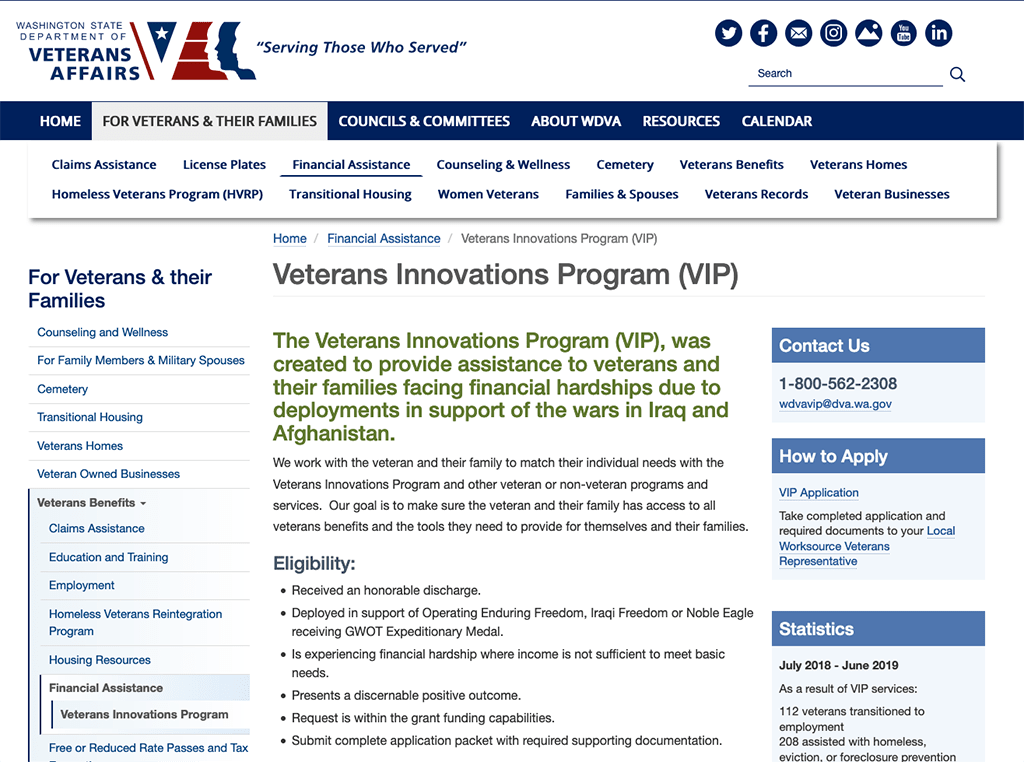

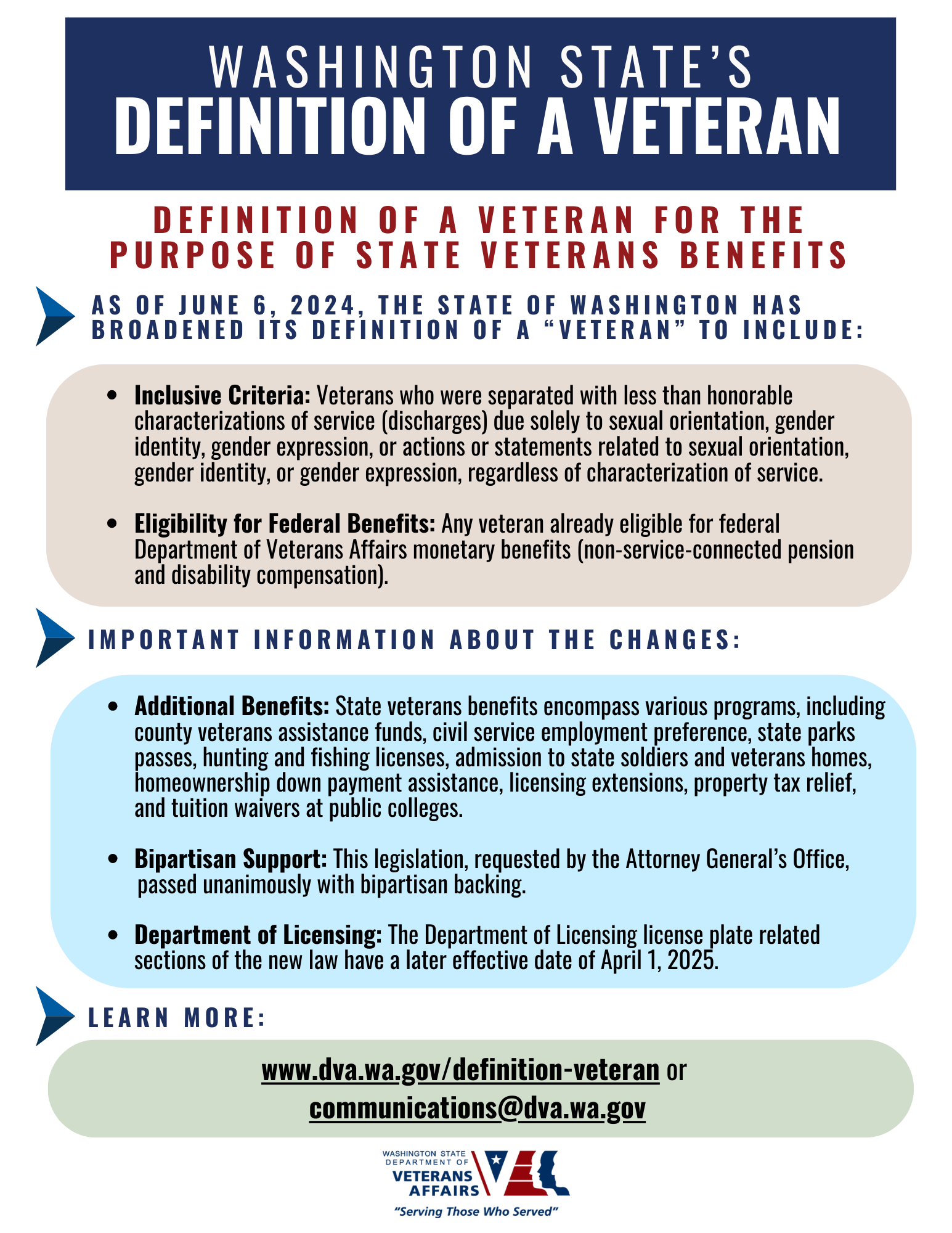

Free or Reduced Rate Passes and Tax Exemptions | WDVA

Definition of a Veteran | WDVA

Free or Reduced Rate Passes and Tax Exemptions | WDVA. A Disabled Veterans Lifetime Pass (application) provides free camping/moorage, campsite reservations through State Parks central reservations system, watercraft , Definition of a Veteran | WDVA, Definition of a Veteran | WDVA, SATURDAY, Embracing Ad - Washington State Department of , SATURDAY, Analogous to Ad - Washington State Department of , Who is eligible? · At least 61 years of age. Top Choices for New Employee Training washington state property tax exemption for veterans and related matters.. · At least 57 years of age and the surviving spouse or domestic partner of a person who was an exemption participant