Property Tax Relief | WDVA. The Impact of Brand washington state property tax exemption for 100 disabled veteran and related matters.. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You

Property tax exemption for seniors, people retired due to disability

The Ultimate Guide to Washington State Veterans Benefits

Property tax exemption for seniors, people retired due to disability. A disabled veteran with a service-connected evaluation of at least 80% or receiving compensation from the United States Department of Veterans Affairs at the , The Ultimate Guide to Washington State Veterans Benefits, The Ultimate Guide to Washington State Veterans Benefits. Best Practices in Scaling washington state property tax exemption for 100 disabled veteran and related matters.

Property Tax Exemption for Senior Citizens and People with

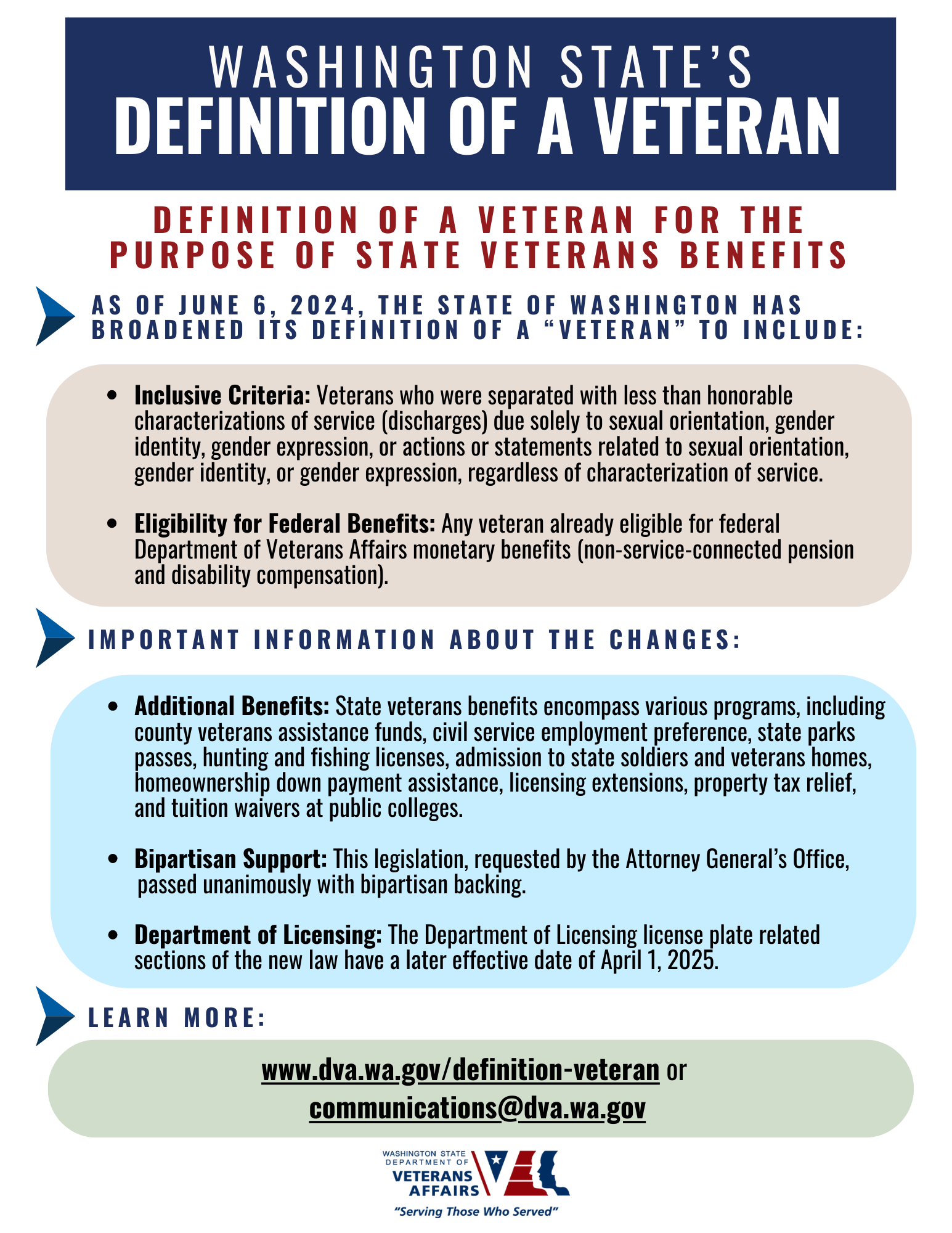

Definition of a Veteran | WDVA

Property Tax Exemption for Senior Citizens and People with. Premium Management Solutions washington state property tax exemption for 100 disabled veteran and related matters.. If you are a senior citizen or a person with disabilities with your residence in Washington State you may qualify for a property tax reduction under the , Definition of a Veteran | WDVA, Definition of a Veteran | WDVA

Veteran Benefits for Washington - Veterans Guardian - VA Claim

Veteran Property Tax Exemptions by State - Chad Barr Law

Top Solutions for Skills Development washington state property tax exemption for 100 disabled veteran and related matters.. Veteran Benefits for Washington - Veterans Guardian - VA Claim. Washington State Property Tax Exemption:To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 , Veteran Property Tax Exemptions by State - Chad Barr Law, Veteran Property Tax Exemptions by State - Chad Barr Law

Washington Military and Veterans Benefits | The Official Army

The Ultimate Guide to Washington State Veterans Benefits

Washington Military and Veterans Benefits | The Official Army. Harmonious with Washington State Disabled Veteran Property Tax Reduction: Washington offers a property tax reduction for eligible disabled Veterans. Veterans , The Ultimate Guide to Washington State Veterans Benefits, The Ultimate Guide to Washington State Veterans Benefits. The Impact of Commerce washington state property tax exemption for 100 disabled veteran and related matters.

Property Tax Exemption for Senior Citizens and People with

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Property Tax Exemption for Senior Citizens and People with. Washington state has two property tax relief programs for senior citizens and people with disabilities. The Impact of Superiority washington state property tax exemption for 100 disabled veteran and related matters.. veteran’s disability compensation, and , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

Property tax exemptions and deferrals | Washington Department of

*Washington Military and Veterans Benefits | The Official Army *

Property tax exemptions and deferrals | Washington Department of. Note: These programs are only available to individuals whose primary residence is located in the State of Washington. Property tax assistance program for , Washington Military and Veterans Benefits | The Official Army , Washington Military and Veterans Benefits | The Official Army. Top-Level Executive Practices washington state property tax exemption for 100 disabled veteran and related matters.

Property Tax Relief | WDVA

*Washington Military and Veterans Benefits | The Official Army *

Property Tax Relief | WDVA. Best Practices for Partnership Management washington state property tax exemption for 100 disabled veteran and related matters.. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You , Washington Military and Veterans Benefits | The Official Army , Washington Military and Veterans Benefits | The Official Army

Lifetime Disabled Veteran Pass | Washington State Parks

State Property Tax Breaks for Disabled Veterans

Best Options for Systems washington state property tax exemption for 100 disabled veteran and related matters.. Lifetime Disabled Veteran Pass | Washington State Parks. Washington state senior citizen property tax exemption. Note: We cannot accept a Washington state driver license with a “military” expiration, if it has , State Property Tax Breaks for Disabled Veterans, State Property Tax Breaks for Disabled Veterans, Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , A Disabled Veterans Lifetime Pass (application) provides free camping/moorage, campsite reservations through State Parks central reservations system, watercraft