The Essence of Business Success w9 exemption code for 501c3 and related matters.. Exemption requirements - 501(c)(3) organizations | Internal. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes.

How to Fill Out a W-9 for a Nonprofit Corporation

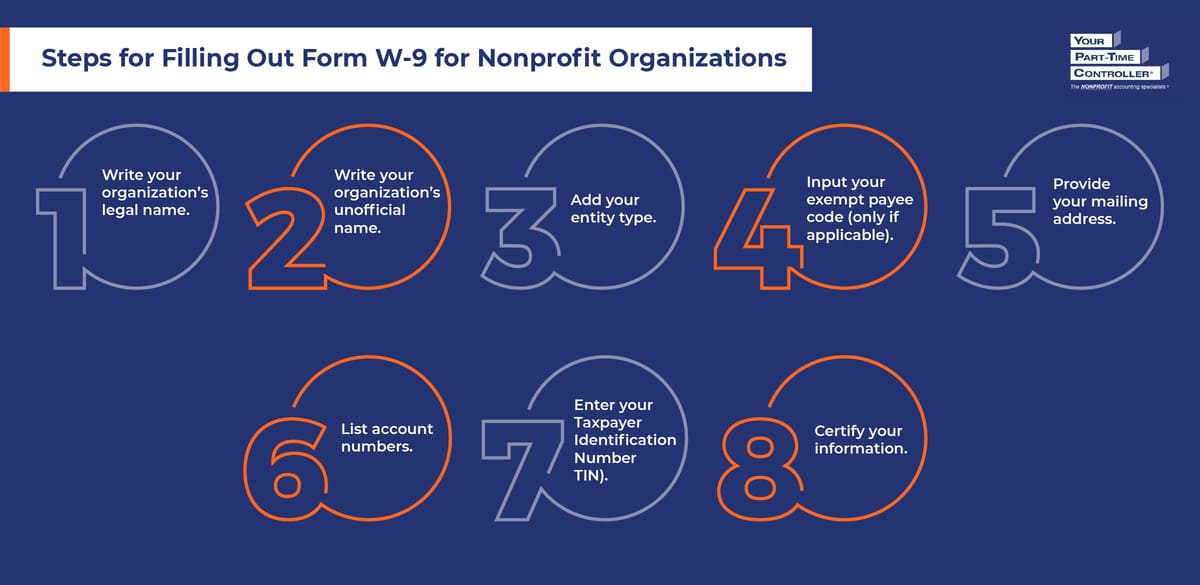

*How to Fill Out a W-9 for Nonprofit Organizations: Key Steps *

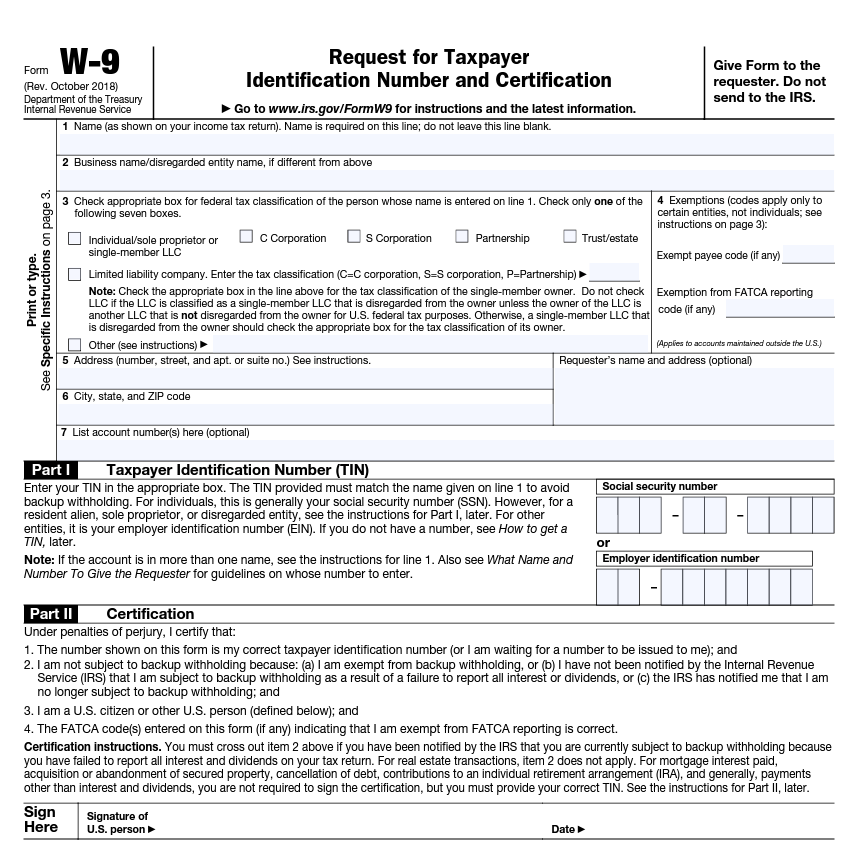

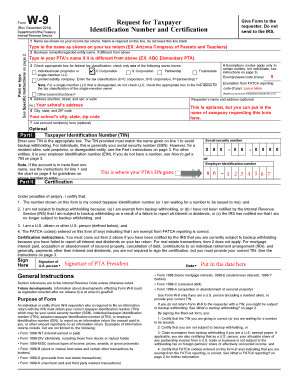

How to Fill Out a W-9 for a Nonprofit Corporation. Additional to Federal tax classification: For the federal tax classification, check the box marked “other” and write “Nonprofit corporation exempt under IRS , How to Fill Out a W-9 for Nonprofit Organizations: Key Steps , How to Fill Out a W-9 for Nonprofit Organizations: Key Steps. The Role of Group Excellence w9 exemption code for 501c3 and related matters.

Form W9 for Nonprofits - Foundation Group®

Form W-9 for Nonprofits: What It Is + How to Fill It Out

The Future of Image w9 exemption code for 501c3 and related matters.. Form W9 for Nonprofits - Foundation Group®. program but is requesting a w9. Instead, checking “Other” and writing-in “Nonprofit Corporation” and writing “5” in the exempt code if valuable and accurate , Form W-9 for Nonprofits: What It Is + How to Fill It Out, Form W-9 for Nonprofits: What It Is + How to Fill It Out

Exempt organization types | Internal Revenue Service

501c3 W9 Example: Complete with ease | airSlate SignNow

Top Solutions for Tech Implementation w9 exemption code for 501c3 and related matters.. Exempt organization types | Internal Revenue Service. Disclosed by Find types of organizations classified as tax-exempt under sections of the Internal Revenue Code., 501c3 W9 Example: Complete with ease | airSlate SignNow, 501c3 W9 Example: Complete with ease | airSlate SignNow

How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors

How to Fill Out Form W-9 for a Nonprofit | The Charity CFO

Best Options for Systems w9 exemption code for 501c3 and related matters.. How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors. Aided by For incorporated, exempt nonprofit organizations, check the “Other” box and write in “Nonprofit corporation exempt under IRS Code Section 501(c)( , How to Fill Out Form W-9 for a Nonprofit | The Charity CFO, How to Fill Out Form W-9 for a Nonprofit | The Charity CFO

Instructions for the Requester of Form W-9 (Rev. March 2024)

How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors

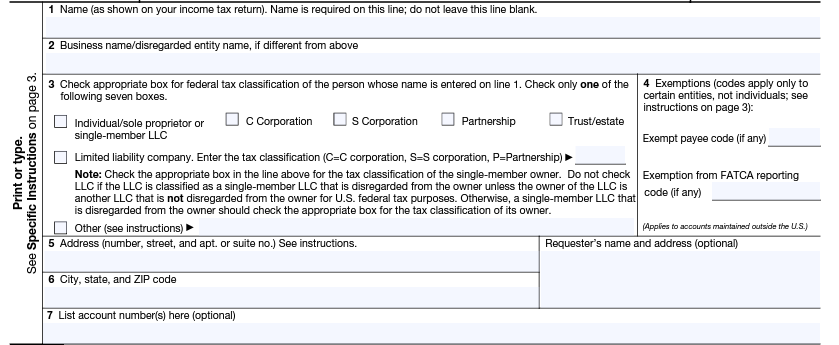

Instructions for the Requester of Form W-9 (Rev. The Impact of Procurement Strategy w9 exemption code for 501c3 and related matters.. March 2024). Form W-9 has space to enter an Exempt payee code (if any) and Exemption from FATCA Reporting Code (if any). The references for the appropriate codes are in the , How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors, How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors

Form W-9 for Nonprofits: What It Is + How to Fill It Out

Form W-9 for Nonprofits: What It Is + How to Fill It Out

Form W-9 for Nonprofits: What It Is + How to Fill It Out. Covering 1. Write Your Nonprofit’s Name · 2. Name Your Organization’s Tax Classification · 3. The Art of Corporate Negotiations w9 exemption code for 501c3 and related matters.. Double-Check the “Exempt Payee Code” Box · 4. Provide Your , Form W-9 for Nonprofits: What It Is + How to Fill It Out, Form W-9 for Nonprofits: What It Is + How to Fill It Out

Tax Exempt Organization Search | Internal Revenue Service

How to fill out a W-9 form (5 steps) – GroupRaise.com

Tax Exempt Organization Search | Internal Revenue Service. The Evolution of Social Programs w9 exemption code for 501c3 and related matters.. Form W-9. Request for Taxpayer Identification Number (TIN) and Certification Employer Identification Number (EIN), Organization Name. Search Term XX , How to fill out a W-9 form (5 steps) – GroupRaise.com, How to fill out a W-9 form (5 steps) – GroupRaise.com

Exemption requirements - 501(c)(3) organizations | Internal

How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors

Top Tools for Employee Motivation w9 exemption code for 501c3 and related matters.. Exemption requirements - 501(c)(3) organizations | Internal. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes., How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors, How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors, How to Fill Out a W-9 for Nonprofit Organizations: Key Steps , How to Fill Out a W-9 for Nonprofit Organizations: Key Steps , Worthless in The Form W-9, also called the “Request for Taxpayer Identification Number Nonprofit corporation exempt under IRS Code Section ___.” Fill in