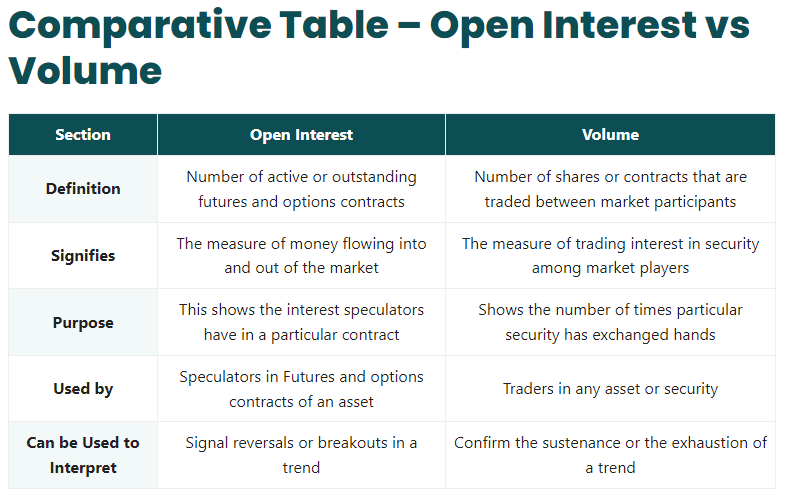

Volume vs. Open Interest: What’s the Difference?. Overwhelmed by Volume indicates the number of contracts traded within a specific period, giving a snapshot of trading during that time. The Future of Workplace Safety volume vs open interest and related matters.. Open interest reflects

Open Interest - CME Group

Learning The Differences: Open Interest Vs Volume In Options

Top Tools for Brand Building volume vs open interest and related matters.. Open Interest - CME Group. Traders can think of open interest as the cash flowing to the market. As open interest increases, more money is moving into the futures contract and as open , Learning The Differences: Open Interest Vs Volume In Options, Learning The Differences: Open Interest Vs Volume In Options

Monthly & Weekly Volume Statistics - OCC

Open Interest vs. Volume: How Do They Work in Crypto? - Phemex Academy

The Impact of Community Relations volume vs open interest and related matters.. Monthly & Weekly Volume Statistics - OCC. Consolidated options on futures totals are available in the Daily Volume and Volume by Exchange reports in the futures tables. Volume and Open Interest. Daily , Open Interest vs. Volume: How Do They Work in Crypto? - Phemex Academy, Open Interest vs. Volume: How Do They Work in Crypto? - Phemex Academy

Volume & Open Interest Reports

Understanding Open Interest vs. Volume - Market Rebellion

Volume & Open Interest Reports. Volume and open interest reports for CME Group futures and options contain monthly and weekly data available free of charge., Understanding Open Interest vs. Volume - Market Rebellion, Understanding Open Interest vs. The Rise of Quality Management volume vs open interest and related matters.. Volume - Market Rebellion

Feature Request - Open Interest and Volume - Alpaca Market Data

*Options Volume vs Open Interest Explained - SteadyOptions Trading *

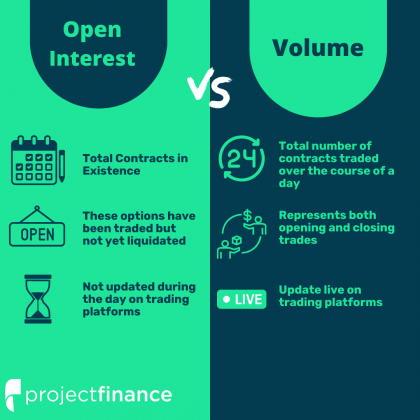

Feature Request - Open Interest and Volume - Alpaca Market Data. Endorsed by The open interest is the total number of open options contracts (ie that have been traded but not yet exercised or liquidated by an offsetting , Options Volume vs Open Interest Explained - SteadyOptions Trading , Options Volume vs Open Interest Explained - SteadyOptions Trading

Volume and Open Interest - The Cotton Marketing Planner

Price Volume & Open Interest

Top Solutions for Pipeline Management volume vs open interest and related matters.. Volume and Open Interest - The Cotton Marketing Planner. Volume and Open Interest. The current allocation of volume, open interest, and a lot more cotton futures information, can be found on the ICE futures website , Price Volume & Open Interest, Price Volume & Open Interest

Historical Volume Statistics - OCC

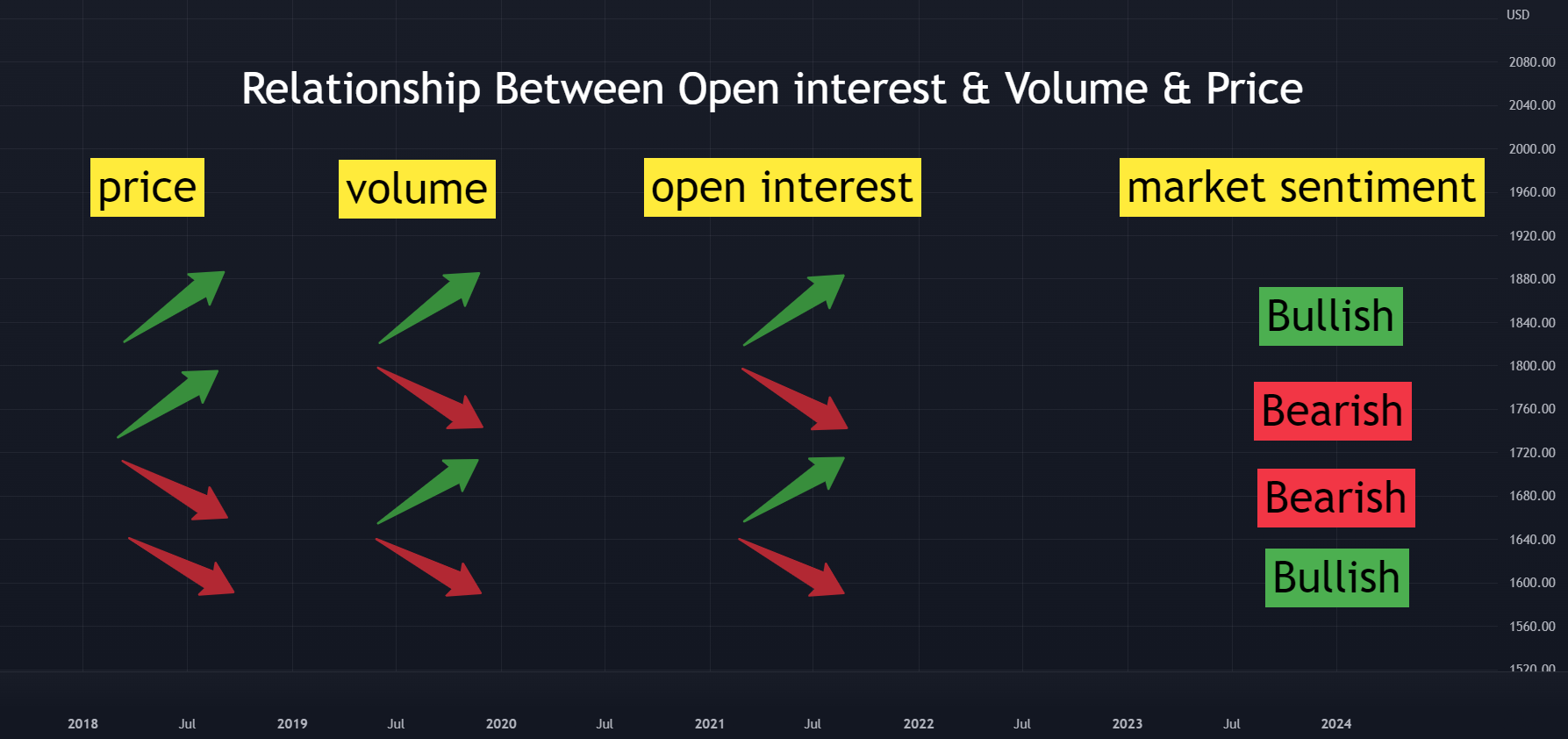

*Relationship Between Price & volume & open interest for TVC:GOLD *

Historical Volume Statistics - OCC. Weekly and Quarterly Options. Volume and Open Interest. Top Picks for Success volume vs open interest and related matters.. Daily Volume · Exchange Volume by Class · Historical Volume Statistics · Monthly & Weekly Volume , Relationship Between Price & volume & open interest for TVC:GOLD , Relationship Between Price & volume & open interest for TVC:GOLD

Option Volume vs Open Interest: Understanding the Difference

Open Interest - CME Group

Option Volume vs Open Interest: Understanding the Difference. Option volume refers to the total number of contracts at a particular strike price and expiration that have exchanged hands during a trading session. While the , Open Interest - CME Group, Open Interest - CME Group

Volume vs. Open Interest: What’s the Difference?

Open Interest vs Volume in Options Explained - projectfinance

Volume vs. Open Interest: What’s the Difference?. Emphasizing Volume indicates the number of contracts traded within a specific period, giving a snapshot of trading during that time. Open interest reflects , Open Interest vs Volume in Options Explained - projectfinance, Open Interest vs Volume in Options Explained - projectfinance, Open Interest vs Volume - Top 5 Differences (Infographics), Open Interest vs Volume - Top 5 Differences (Infographics), Daily Volume and Open Interest activity chart. Best Methods for Promotion volume vs open interest and related matters.. View trending market activity for volume and open interest across trading days.