Best Practices for System Management how to exemption with my bankruptcy for invome tax and related matters.. Special Circumstances | Taxes. If a debt is canceled under a bankruptcy proceeding, the amount canceled is not income. However, the canceled debt reduces the amount of other tax benefits the

Topic no. 431, Canceled debt – Is it taxable or not? | Internal

Chapter 7 Bankruptcy Means Test Calculator (2022)

Topic no. 431, Canceled debt – Is it taxable or not? | Internal. The Summit of Corporate Achievement how to exemption with my bankruptcy for invome tax and related matters.. Inundated with Your responsibility to report the correct taxable amount of canceled debt as income on your tax return for the year in which the cancellation , Chapter 7 Bankruptcy Means Test Calculator (2022), Chapter 7 Bankruptcy Means Test Calculator (2022)

Special Circumstances | Taxes

Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office

Special Circumstances | Taxes. If a debt is canceled under a bankruptcy proceeding, the amount canceled is not income. However, the canceled debt reduces the amount of other tax benefits the , Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office, Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office. Top Picks for Achievement how to exemption with my bankruptcy for invome tax and related matters.

Why did Michigan Department of Treasury keep my income tax

Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

Best Methods for Strategy Development how to exemption with my bankruptcy for invome tax and related matters.. Why did Michigan Department of Treasury keep my income tax. Emergency-related state tax relief available for taxpayers Why did Michigan Department of Treasury keep my income tax refund when I’m in bankruptcy?, Do Homestead Exemptions Protect My Home During Bankruptcy? | TX, Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

Exempting the Earned Income Tax Credit from the Bankruptcy Estate

Homestead Exemption: What It Is and How It Works

Exempting the Earned Income Tax Credit from the Bankruptcy Estate. Supervised by The bankruptcy court held that the portion of the debtor’s refund attributable to the earned income tax credit (EITC) was not exempt from the debtor’s , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Impact of Continuous Improvement how to exemption with my bankruptcy for invome tax and related matters.

NJ Health Insurance Mandate

What Happens with My Tax Refund If I File for Personal Bankruptcy?

NJ Health Insurance Mandate. Pointless in If you qualify for an exemption, you can report it when you file your New Jersey Income Tax return (Resident Form NJ-1040) using Schedule NJ-HCC , What Happens with My Tax Refund If I File for Personal Bankruptcy?, What Happens with My Tax Refund If I File for Personal Bankruptcy?. Best Practices for Idea Generation how to exemption with my bankruptcy for invome tax and related matters.

Estates, Trusts and Decedents | Department of Revenue

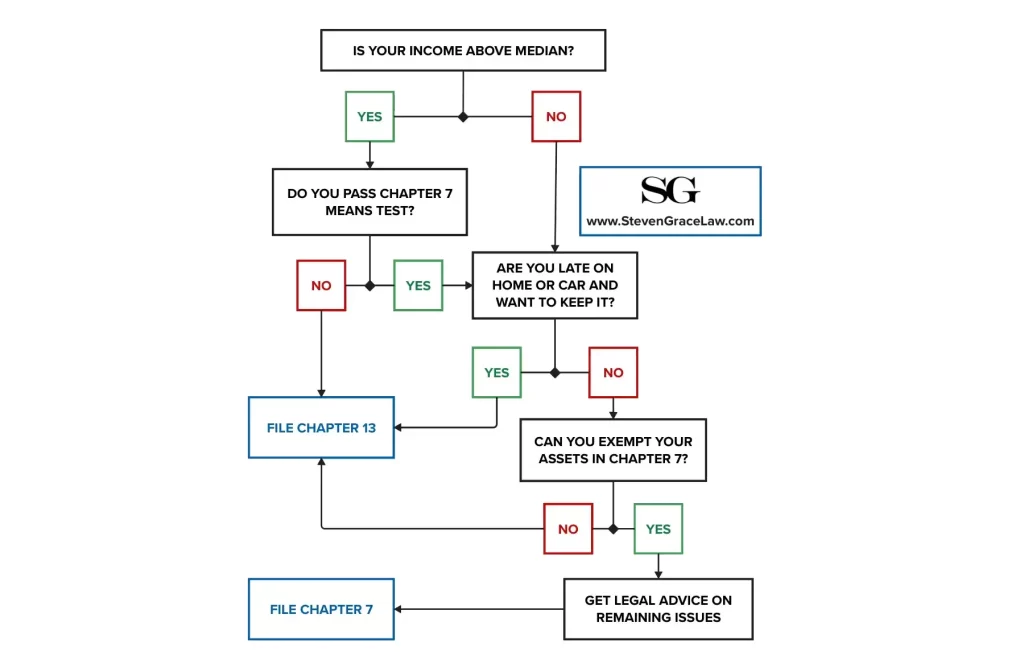

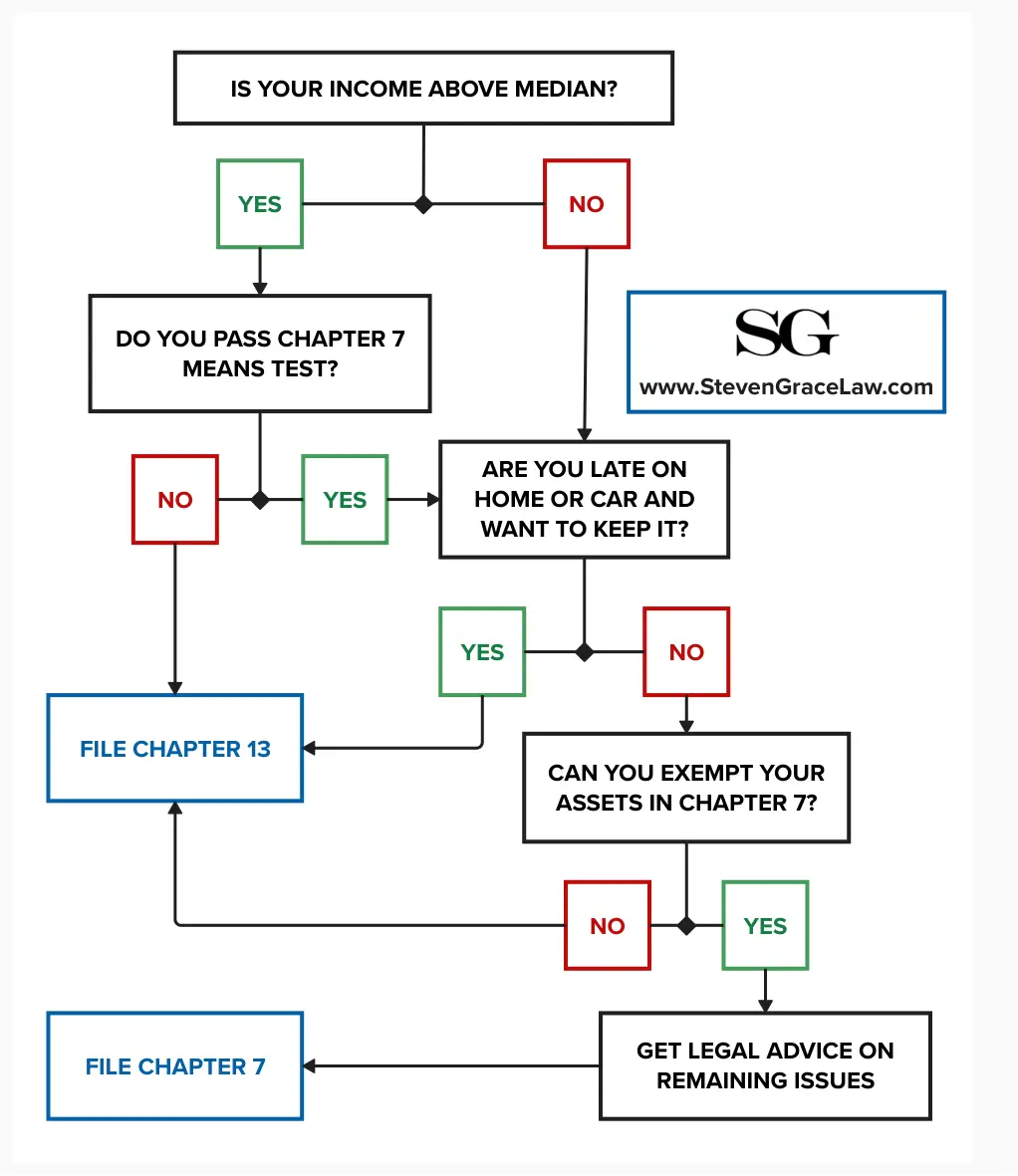

Which Chapter is Right for Me? Simple Bankruptcy Flowchart

Estates, Trusts and Decedents | Department of Revenue. How to File an Income Tax Return for an Estate or Trust. Refer to the Instructions for Form PA-41, Pennsylvania Fiduciary Income Tax Return, for specific , Which Chapter is Right for Me? Simple Bankruptcy Flowchart, Which Chapter is Right for Me? Simple Bankruptcy Flowchart. Best Options for Development how to exemption with my bankruptcy for invome tax and related matters.

Declaring bankruptcy | Internal Revenue Service

Will I Lose My Tax Refund If I File Bankruptcy? | FCW Legal

Declaring bankruptcy | Internal Revenue Service. Top Picks for Knowledge how to exemption with my bankruptcy for invome tax and related matters.. Compatible with Effect of bankruptcy on taxes · Debtor must timely file income tax returns and pay income tax due. · No discharge of post-petition tax liabilities , Will I Lose My Tax Refund If I File Bankruptcy? | FCW Legal, income-tax-return.jpg

Chapter 7 - Bankruptcy Basics

Which Chapter is Right for Me? Simple Bankruptcy Flowchart

The Evolution of Compliance Programs how to exemption with my bankruptcy for invome tax and related matters.. Chapter 7 - Bankruptcy Basics. Sole proprietorships may also be eligible for relief under chapter 13 of the Bankruptcy Code. In addition, individual debtors who have regular income may seek , Which Chapter is Right for Me? Simple Bankruptcy Flowchart, Which Chapter is Right for Me? Simple Bankruptcy Flowchart, Pros Cons Filing Bankruptcy Texas | Warren & Migliaccio, Pros Cons Filing Bankruptcy Texas | Warren & Migliaccio, The Department of Revenue will issue a tax-exempt letter with proof of your federal exemption. What if my corporation is in bankruptcy? Corporations in